How to Use DOT Compliance Programs to Lower Your Commercial Insurance Costs

How do you juggle rising insurance premiums, driver qualification files, FMCSA Clearinghouse queries, and other DOT compliance matters?

To no one’s surprise, owning and operating a trucking company involves a lot of expensive investments. Insurance is one of the top five vehicle-based costs, according to the American Transportation Research Institute’s (ATRI) 2024 Operational Costs of Trucking report.

And if you don’t have enough coverage, facing a multi-million-dollar lawsuit (commonly known as a nuclear verdict) due to your negligence could mean closing your doors for good.

To better your chances of getting lower insurance rates, you’ll need to invest in additional safety precautions and DOT compliance services to prove that you take safety seriously. This is especially true if your fleet has a history of accidents.

Experts in insurance and safety recommend that companies with transportation sectors treat insurance premiums as just one component of their total cost of risk alongside expenses for litigation, training, safety technology, driver compensation, and out-of-pocket incident costs.

A few proven tactics for reducing insurance costs include:

- Modern safety technologies

- Regular vehicle maintenance

- Pristine driver qualification files

In a Truckload Carriers Association (TCA) webinar on leveraging driver data for the best insurance rates, Gary Flaherty, Senior Vice President of commercial auto E&S wholesale at Nationwide said, “Experts in the field can tell really good stories related to the things that you’ve done as a motor carrier, and lots of motor carriers have done really good things. Whether that be investments they’ve made in technology, investments they’ve made in equipment and people, you want to be able to show your insurance company those things so that you’re getting the best rate that you possibly can.”

Here’s how you can be one of those successful, money-saving companies, too.

Implement New Safety Technologies

Flaherty encouraged companies to not only install safety equipment but also use it during their daily operations. Just because it’s in the cab doesn’t mean it’s making a real difference in your drivers’ safety or performance.

A few of the industry’s most popular truck safety systems and their purposes are as follows:

- Fatigue meters: Hours of service (HOS) logs are used to predict fatigue levels by estimating drivers’ sleep patterns in combination with their on-duty periods. Remember, truckers can be on duty for a maximum of 14 hours followed by a minimum ten-hour break.

- Collision warnings: Using cameras and sensors installed on the exterior of trucks, these alert drivers if they are tailgating or traveling too close to the rear end of another vehicle.

- Driver-facing cameras: Recording devices track the habits of drivers for a first-hand look at how they operate their vehicles so easy corrective action can be taken.

- Electronic stability control (ESC): These systems detect low tire traction levels and erratic steering wheel movements to then decrease vehicle speed or reduce engine power. Note: ESC is required in certain passenger vehicles by the National Highway Traffic Safety Administration (NHTSA).

Once you’ve installed any or all of these systems in your cabs, it’s time to see what they’re showing you. If your drivers tend to follow other vehicles too closely, operate their rig while feeling fatigued, or take other risky actions while behind the wheel, you need to address them before they cause accidents.

“It (technology) improves the overall driving performance of the fleet, which we believe there’s a direct correlation to (accident) frequency, which we directly correlate to overall losses,” said Flaherty.

Keep up with Vehicle Maintenance

The safety of your drivers is only half the battle — you need to prioritize the safety of your equipment to lower the chances of accidents. With that in mind, make sure your company has rock-solid policies in place around pre- and post-trip inspections.

Drivers should check over the truck’s exterior components, such as brakes, tires, and headlights, as well as the cab interior before and after every trip they take. If any malfunction, maintenance issue, or load securement problem is noticed, they should know who to report it to so it can be addressed as quickly as possible.

Safety managers should record vehicle defects on driver vehicle inspection reports (DVIRs) and ensure that any issues are repaired before any driver operates the vehicle. When any repairs are made to any company vehicle, the DOT requires these records to be kept:

- Identifying information of the vehicle, including company number, make, serial number, year, and tire size.

- A schedule highlighting the type and due date of inspections and maintenance to be performed.

- Inspection, repair, and maintenance records indicating the date and description of each.

Since you should keep these documents to prepare for an audit anyway, providing them to your insurance carrier is easy. It proves you stay on top of vehicle maintenance and prioritize safe operations – two things they like to see.

Read more about vehicle maintenance recordkeeping requirements in this helpful Foley article.

Create & Maintain Compliant Driver Qualification Files

Non-compliant DOT driver qualification files are a big problem across the industry. In fact, they account for many of the top acute and critical FMCSA violations annually.

It’s not that these files are difficult to create when a new driver is hired (although some steps are often missed in the process), but it can be difficult for companies to keep these files updated on an ongoing basis — and as you may know, the more drivers you hire, the more difficult it gets.

Automation allows you to create a foolproof plan for creating and maintaining compliant driver qualification files. Foley’s DOT compliance software notifies you when annual motor vehicle reports (MVRs) need to be run, or CDL and medical certificate renewals are due. You’ll always have complete, up-to-date driver files with Foley on your side.

To pass an offsite audit, these files must be maintained in a secure, digital format, like the Foley platform.

BONUS TIP: Transparency is Your Superpower

You need to be open and honest with your insurance company about everything you’re doing to improve safety efforts and reduce the risk of accidents across your fleet. Even if this means pointing out some of your flaws — such as accidents or claims from years past — you’re still showing them it’s only up from here.

If they don’t ask, tell them.

Is your MVR monitoring program helping to reduce driver violations year-over-year?

Are your driver qualification files completely digital and more organized than when you first purchased your policy?

Have you kept up with your vehicle maintenance and the recordkeeping that goes along with it?

You need to share documentation of these things with your agent. They won’t know what you don’t tell them. If you’ve taken the time to invest in these safety programs and initiatives, you deserve the credit!

Foley’s DOT Compliance Software Can Help Reduce Your Insurance Premiums

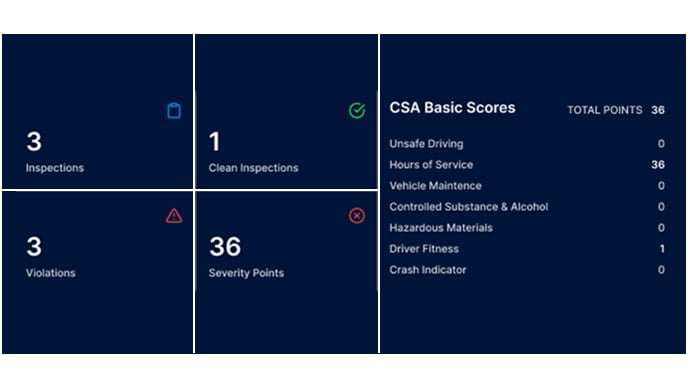

Automating your DOT compliance goes hand-in-hand with reducing your insurance costs. When you use Foley’s DOT compliance software, all your driver qualification file due dates are tracked, MVR checks are run regularly, and your DOT recordkeeping requirements (like FMCSA Clearinghouse queries) are fulfilled. All you’ll need to do is show your agent your Foley platform, and they’ll know you take your fleet’s safety seriously.

Whether you’re a new owner-operator and you’re looking for your first insurance policy, or you’re a seasoned professional in search of a lower premium, Foley can help you find the best rates from our expansive network of insurance providers.

Click here to get a FREE demo of all the safety and compliance programs you need to get your insurance costs in your favor, or fill out the form below!

Related Articles

What to Look for in a Fleet Management Software Solution

DOT Compliance Review: FMCSA Requirements for School Buses & Bus Drivers

How to Recruit More (and Better) Drivers During the Ongoing Truck Driver Shortage

.png)