How to Become an Owner-Operator Truck Driver in 2024

If taking the leap and becoming a trucking owner-operator is one of your New Year's resolutions for 2024, there's a world of new opportunities waiting for you.

There comes a time in most truck drivers’ lives when they consider shrugging off the employee role, getting their own rig, and hitting the road as a trucking owner-operator. When you feel tied down working for someone else’s company, it’s easy to romanticize the idea of making your own rules and picking your loads, but it’s unfortunately not all about hitting the open road and cashing checks.

The trucking owner-operator lifestyle isn't for everyone, but if you think it may be the right next step for you, keep reading. Below, we’ll guide you through how to become an owner-operator — and the realities behind it.

What is an Owner-Operator?

An owner-operator truck driver is someone who not only drives the truck but also runs the business behind it. That means you are responsible for:

- Landing clients and maintaining relationships

- Driving the rig, loading, and unloading

- Planning routes and other associated administrative tasks

- Buying or leasing your rig and equipment

- Maintaining your rig and equipment

- Paying for insurance and other overheads

- Keeping the financial records necessary for any business

- Maintaining DOT records

It also means that you have full freedom to decide which jobs to take and which not to. That means if you hate doing a certain type of work, or dislike working for businesses in a certain industry, you can avoid those jobs or specialize in the work you do enjoy. You also set your own rates, which provided you’re confident and don’t undercharge, can be lucrative and help you make more than you would in an employed position.

A freight agent is also viewed as an owner-operator. This is someone who runs the business side and hires or manages other drivers. If you still operate your rig, this can be a lot of work if you go it alone, so this is usually only a good option if you’ve got a head for business and want to take a step back (in part or fully) from driving.

What's the difference between an owner-operator and a company truck driver?

Unlike a company truck driver, owner-operators have full freedom to decide which jobs to take and which ones to avoid. That means if you hate doing a certain type of work, or dislike working for businesses in a certain industry, you can avoid those jobs or specialize in the work you do enjoy.

A freight agent is also viewed as an owner-operator. This is someone who runs the business side and hires or manages other drivers. If you still operate your rig, this can be a lot of work if you go it alone, so this is usually only a good option if you’ve got a head for business and want to take a step back (in part or fully) from driving.

12 Steps to Becoming a Successful Owner-Operator Truck Driver

Understand the startup costs of running a trucking business

There are very few businesses you can start with no money, and becoming a trucking owner-operator isn’t one of them. Whether you already own a rig, are planning to buy one, or are looking to lease, there are other expenses besides just the cost of the vehicle. Here are some of the costs you’ll need to set a budget for:

- Legal fees and licenses – we’ll get into these in the next section, but this will cost $100 – $1,500 to get started, with some fees paid annually.

- Trucking equipment maintenance – this doesn’t come cheap. Estimates put maintenance costs at $15,000 a year, with annual tire expenses sitting at around $4,000 for an 18-wheeler. The bigger the rig, the bigger the expenses.

- Loans or leases you take out to buy or lease your rig and cover any other startup costs.

- Insurance.

- Living expenses (including your own health insurance) until your business starts covering them.

- Marketing – a website and other ads if/as necessary.

Do your research on what it will cost you to get your business up and running. You can often bootstrap and save money, but make sure you don’t cut corners where you shouldn’t.

Outline a Business Plan

Your next step should be to consider how you wish to operate your new business. You have two options:

- Operate your own business under your own authority, or

- Lease your vehicle out to a motor carrier

Option 1, operating your own business under your own authority, will allow you to make all the decisions, grow your business, and ultimately, make more money. You’ll need to market your business, make connections, and try to find your niche where you are the go-to for customers of a certain type, who need a certain thing from you, or in a certain area. This is the option to choose if you want to be a free agent, with the possibility of growing in the future to have other drivers working for you.

Option 2, leasing to a motor carrier, means you are self-employed but essentially have an agent to act for you, ensuring you have work and they may also cover some of the expenses associated with doing business as an owner-operator. This is a good option if you want to be self-employed and have some freedom, but are concerned about your ability to find work and market yourself. The downside here is, clearly, they take a cut for their side of the work.

Form a Business Entity

Foley highly recommends working with a trusted accountant to help you decide which type of business structure will work best for your new company. You may choose from a sole proprietorship, partnership, LLC, or corporation. Each of these units has different levels of liability, and the tax rates depend on your operating state.

Find out more about the business entity options you have in this Foley article.

Get a commercial driver's license (CDL)

If you already have a CDL, you can skip this section.

But if not, you'll need to find out how to get a CDL before becoming an owner-operator. The FMCSA offers step-by-step instructions to help you get started. You may also require specific license classes and endorsements, depending on the type of commercial vehicles you'd like to operate and the categories of freight you plan on hauling.

Familiarize Yourself with Federal Requirements for Owner-Operators

Heavy Vehicle Use Tax

If you operate a commercial motor vehicle (CMV) over 55,000 pounds, you’ll need to pay HVUT. Note that this weight is unladen – so a fully equipped rig without a load. HVUT is an annual fee, and the cost will depend on the size of your vehicle.

Any vehicle between 55,000 and 75,000 pounds will pay $100 a year, plus an additional $22 for every 1,000 pounds above 55,000 pounds. This means the minimum fee will be $100, and the maximum is $530. If your CMV is over 75,000 pounds, you’ll pay a flat rate of $550. (Note: if a CMV is driven less than 5,000 miles a year, you can use IRS form 2290 to apply for an exemption.)

International Fuel Tax Agreement

As an owner-operator, you may need to file under the International Fuel Tax Agreement (IFTA). Those who file simply report their fuel use and pay taxes on it accordingly. If you operate out of a qualifying state, you must complete an IFTA registration on an annual basis. Then, in most states, you will then file your IFTA fuel taxes on a quarterly basis.

If you operate a vehicle with two axels and a gross rate of over 26,000 pounds or operate a vehicle with more than two axels (regardless of weight), you’ll need to display two decals on the exterior of the cab and carry a photocopy of the IFTA license. To register for IFTA, you’ll need your USDOT number, federal business number, and registered business name, and must apply through your home state agency.

For more information on IFTA, Foley answers fuel tax FAQs on this page.

File for a USDOT Number and MC Number

Most owner-operators need a USDOT number, but not all. If you plan to drive for passengers, transport hazardous material, or deliver interstate freight, you’ll need this number. You can find out if you need a USDOT number here.

You may also need an MC number, which is needed for transporting regulated commodities. An MC number is an “authority to operate” number. To find out if you need an MC number, click here.

File a BOC-3 Form

The BOC-3 (blanket of coverage) form designates an agent who can file legal documents on your behalf and is required for motor carriers, brokers, and freight forwarders by the federal government.

Foley covers BOC-3 form filing in blog our informative blog article, How to File Your BOC-3 Form: A Step-by-Step Guide.

Decide Whether to Buy or Lease a Truck

Investing in your own truck is not only fun, but it also comes with the excitement of knowing you’re starting something new. The good news is that purchasing a truck (and other equipment) will give your business an asset. Make sure you carefully consider what you plan to do and buy something that will manage it easily.

If you don’t want to buy a semi truck outright, there are plenty of opportunities to lease one. Like leasing a car, you’ll find companies are ready to lease your vehicle to you, though it may not be at an affordable rate. Make sure you shop around and understand exactly what the lease will mean for your bottom line. Lease operator requirements vary from company to company, so find those with requirements you fit and make sure they are well-rated before moving forward.

The last thing you want is to start your new business and be unable to make good money because your lease takes too much from your bottom line. For example, a Percent of Revenue lease is a great way to make sure you pay it back (often with more flexible terms). Just make sure that it’s a percentage you can afford to pay.

Purchase Trucking Insurance

Insurance is a big factor in becoming a legitimate owner-driver, but what you need (and can get) will depend on how you choose to operate. Those planning to work with a motor carrier will often find that the motor carrier offers some insurance coverage, but it is often lacking.

Make sure you get coverage to protect you in all situations, not just what is necessary to be legal on the road. Some of the types of insurance policies you may need if you are working for a motor carrier are:

- Physical damage coverage – this covers the cost of damages to your vehicle if it is involved in an accident.

- Non-trucking liability insurance – this covers you (the driver) when you are not working for the motor carrier.

- Motor truck cargo coverage – this covers any goods you are hauling if they are damaged or stolen in transit.

- Lease gap coverage – this covers you if your vehicle is totaled and the value of the vehicle is less than the amount you owe on the lease.

If you are going to work completely independently, then you should be able to find a policy that covers all of the bases for you.

Regardless, make sure you do your research thoroughly to get the right coverage at the right price.

Find Your First Load

The most common way owner-operators find work is through load boards. Here, brokers and freight forwards will post the freight they need to be moved when and where. Some of the most popular load boards you may have heard of are the DAT load board, Landstar load board, or Truckstop load board. But there are plenty of other load boards out there for you to find consistent work across the country.

Remember, getting access to some of the best load boards may be another business expense for you. You may wish to research free load boards when you're first starting out as an owner-operator.

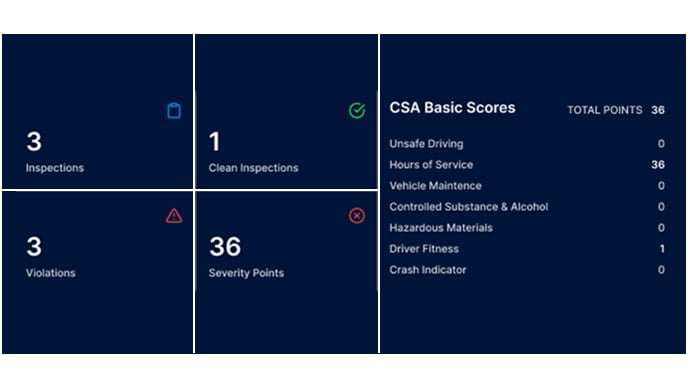

Maintain DOT Records and Documentation

Being a CMV driver isn’t without its administrative tasks, but being an owner-operator certainly multiplies these tenfold. You need to keep your DOT records up to date, keep track of invoices and other financial matters, and ensure you file your taxes on time.

If this isn’t your forte, consider hiring someone to help you a few hours a week to ensure you stay on top of things (this can simply be your spouse, family friend, or other trusted individual), but working with a DOT compliance partner is the best way to ensure you're staying on top of your DOT record-keeping requirements.

Stay on Top of Your Taxes

In addition to the HVUT and IFTA taxes we covered above, owner-operators are also responsible for business and self-employment taxes. Each state carries different tax rates, so it's best to work with your accountant to ensure you're prepared to file and pay according to your specific business requirements.

Being financially conservative as you start a trucking company can help you prepare for your new tax liabilities.

Start Your Journey as a New Owner-Operator

Now that you know how to become an owner-operator, you can easily see how it can be one of the best decisions you’ll make in your career, but it’s certainly not one to jump into without having an accurate idea of your costs vs. profit.

Do your research and talk to any friends or acquaintances that have already made the jump. With a realistic view of what to expect, you’ll be able to move confidently forward with your new life as an owner-operator in 2024.

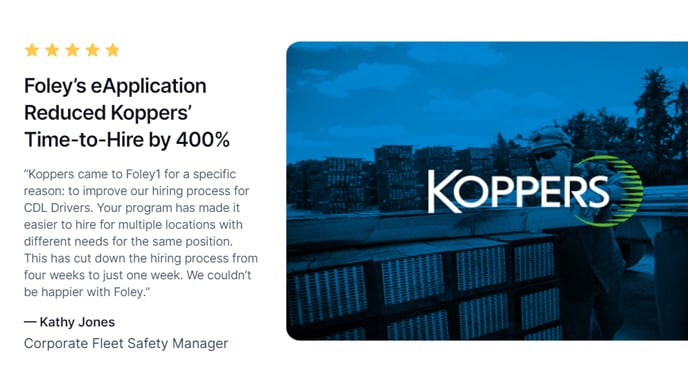

Foley can be a dependable partner throughout the exciting yet overwhelming process of becoming an owner-operator. From filing your DOT number and operating authority to purchasing insurance and passing your new entrant safety audit, we're here for you!

Fill out the form below if you're ready to take the next steps in becoming a trucking owner-operator.

Related Articles

DOT Takes Action to Improve Driver Recruitment & Retention

Pirates of the Trucking Industry

A Step Toward Roadway Safety: Large Truck & Bus Crashes on the Decline

.png)