Hours of Service and IFTA

Regulation Breakdown

The table below outlines key regulatory requirements and provides our recommended solutions for maintaining compliance. For more information, please call a Compliance Specialist at 1-800-253-5506

Hours of Service

| Requirement | Solution |

| Drivers who travel beyond a 100 air-mile radius must record their duty status using a graph grid log. (49 CFR 395.8) | Our Electronic Logging Device (ELD) solution from KeepTruckin will enhance your productivity and increase the accuracy of your driver logs. |

| Drivers who travel less than 100 air miles must maintain time sheets documenting when they report to and are released from work, and the number of hours they are on duty each day. (49 CFR 395.8) | Our Driver’s Exemption Log includes four months of time sheets on 31 two-ply carbonless pages. This log can also be used for drivers of smaller CMVs who travel up to 150 miles. |

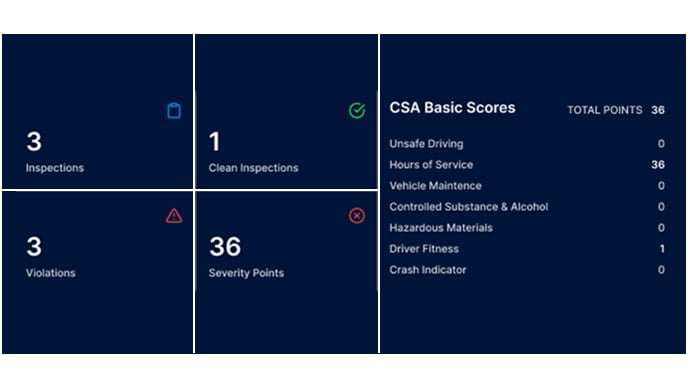

| Employers are liable for the hours of service violations of their employees. FMCSA has issued guidance that employers should have a system in place to verify the accuracy of a driver’s duty status and review any supporting documentation. (49 CFR 395.8) | Foley’s Electronic Logging Device (ELD) solution and corresponding web portal from KeepTruckin allows employers to see real-time data on how many hours a driver has traveled and whether they’ve logged any hours of service violations. |

IFTA

| Requirement | Solution |

| All drivers with a vehicle that weighs more than 26,000 pounds or has more than three axles (regardless of weight), must file their IFTA tax returns each quarter. These reports must include the fuel usage and miles driven in each state. | Our mobile application uses GPS to record both the vehicle’s odometer reading and location, creating accurate and automatic records of how many miles you drove in each jurisdiction. It also records special mileage exemptions, such as miles driven on toll roads. |

| As part of the IFTA reporting requirements, drivers must keep records of their fuel purchases. These records must include the purchaser’s name, the vendor’s name and address, the date of purchase, the unit number of the vehicle that purchased the fuel, the type of fuel purchased, the price per gallon and the number of gallons purchased. | Our mobile application allows you to capture and save electronic documents with the use of your mobile camera. Simply take a photo of your fuel receipts and the app will store them safely. |

Vehicle Maintenance Files

| Requirement | Solution |

| At the end of each shift, the driver must perform a detailed inspection of their vehicle. If they find any problems, they must document them by completing and signing a Driver Vehicle Inspection Report (DVIR). (49 CFR 396.11) | The mobile application used with our Electronic Logging Device (ELD) solution from KeepTruckin simplifies the process of performing daily vehicle inspections by allowing you to quickly select vehicle issues you need to document. |

| Motor carriers must develop and maintain a systematic inspection program to keep vehicles in safe operating condition. (49 CFR 396.13) | Use our mobile application from KeepTruckin to perform systematic vehicle inspections. |

| Every CMV operated by a DOT-regulated motor carrier must undergo an annual inspection. (49 CFR 396.17) | Use our mobile application from KeepTruckin to perform annual vehicle inspections. |

Hours of Service

The Hours of Service regulations govern how long you can work and drive for, when you must take breaks and how long you must wait before you can work again once you reach your limits. If your Commercial Motor Vehicle meets the following criteria, you must follow the Hours of Service rules:

- Has a gross vehicle weight rating or gross combination weight rating of 10,001 pounds or more

- Is designed or used to transport 16 or more passengers (including the driver) not for compensation

- Is designed or used to transport 9 or more passengers (including the driver) for compensation

- Is transporting hazardous materials in a quantity requiring placards

- Does not operate exclusively within 100 air miles of home and does not return home each day (or operate within 150 air miles by a non-CDL driver).

The Hours of Service rules were rewritten in 2013. The current rules are as follows:

| Property-Carrying Drivers |

| 11-Hour Driving Limit May drive a maximum of 11 hours after 10 consecutive hours off duty. (49 CFR 395.3) |

| 14-Hour Limit May not drive beyond the 14th consecutive hour after coming on duty, following 10 consecutive hours off duty. Off-duty time does not extend the 14-hour period. (49 CFR 395.3) |

| 60/70-Hour Limit May not drive after 60/70 hours on duty in 7/8 consecutive days. A driver may restart a 7/8 consecutive day period after taking 34 or more consecutive hours off duty. This must include two periods from 1 a.m. to 5 a.m. home terminal time, and may only be used once per week, or 168 hours, measured from the beginning of the previous restart. (49 CFR 395.3) |

| Sleeper Berth Provision Drivers using the sleeper berth provision must take at least 8 consecutive hours in the sleeper berth, plus a separate 2 consecutive hours either in the sleeper berth, off duty, or any combination of the two. (49 CFR 395.3) |

| Rest Breaks May drive only if 8 hours or less have passed since the end of driver’s last off-duty or sleeper-berth period of at least 30 minutes. [49 CFR 397.5 mandatory “in attendance” time may be included in break if no other duties performed] (49 CFR 395.3) |

| Passenger-Carrying Drivers |

| 10-Hour Driving Limit May drive a maximum of 10 hours after 8 consecutive hours off duty. (49 CFR 395.5) |

| 15-Hour Limit May not drive after having been on duty for 15 hours, following 8 consecutive hours off duty. Off-duty time is not included in the 15-hour period. (49 CFR 395.5) |

| 60/70-Hour Limit May not drive after 60/70 hours on duty in 7/8 consecutive days. (49 CFR 395.5) |

| Sleeper Berth Provision Drivers using a sleeper berth must take at least 8 hours in the sleeper berth, and may split the sleeper berth time into two periods provided neither is less than 2 hours. (49 CFR 395.5) |

International Fuel Tax Agreement

What Is IFTA?

You are required to file your IFTA tax returns by the last day of each quarter. These returns are due from every motor carrier with an IFTA license, even if they didn’t use any taxable fuel that quarter. Failure to submit your returns on time will lead to fines or license suspensions.

What Is An IFTA License?

Under the IFTA, you are issued an IFTA license and one set of your State IFTA decals for your truck, which will allow you to operate in all other IFTA jurisdictions. A copy of the IFTA license may be used in your truck instead of the original license.

Documentation For Your IFTA Tax Return

The information reported on your tax return must be carefully documented. These records can be saved on microfile, microfiche, paper or digital imaging and must include all of your fuel receipts and daily mileage records. We have developed a comprehensive solution for carriers to help them fulfill their IFTA requirements. Using our distinctive blue Daily Trip Reports, Foley Clients track their routes and record their fuel purchases. Once the Trip Report is complete, clients submit their information to us and we go to work. We provide you with accurate, professional reports for you to submit to your state. It’s as simple as that: IFTA goes from being a quarterly headache to as simple as opening your mail. Plus, with a Foley Fuel Card, your purchases are tracked for you, meaning less paperwork and less room for expensive errors.

With the new ELD mandate requiring most motor carriers to have an electronic logging device by December 2017, more and more drivers will be using ELDs in their trucks. In addition to simplifying hours of service reporting, ELDs also makes it easy to track IFTA data. At Foley, we have an ELD and mobile application powered by KeepTruckin that work together seamlessly to automatically record the number of miles you drove in each jurisdiction, along with your fuel usage. You can also snap photos of your receipts in the mobile application to save all of your supporting documentation securely.

If you pair the ELD with the Foley Fuel Card to track your Fuel Receipts, you’ll have an automatic and seamless IFTA data collection process.

If you need to track exemptions, such as miles driven on toll roads, the ELD and mobile application can handle that, too.

For more information on how Foley can help automate your IFTA reporting, call us at (800) 253-5506 or visit us online at www.foleyservices.com.

Daily Vehicle Inspections

You are required to check on the condition of your vehicles every day you use them. Foley uses a free mobile application powered by KeepTruckin that makes it easy to conduct these daily vehicle inspections. Once you open a new report in the app from KeepTruckin, you’ll be prompted to enter your trip information, along with any vehicle issues that need to be documented and fixed. Simply tap the issues you’d like to report from the inspection checklist and send it to your fleet manager immediately to schedule the vehicle’s repair.