New Bill Offers Tax Credits & Grants to Truck Drivers

Whether you recruit truck drivers, are a truck driver, or you're about to take your CDL test, these truck driver tax credits may be of interest to you!

If you’re a truck driver or considering a new career in trucking, keep reading.

A new bill proposing some impressive financial incentives for those in the transportation industry is part of the Safer Highways and Increased Performance for Interstate Trucking (SHIP IT) Act, which aims to reform and maximize the efficiency of the US trucking industry and improve the recruiting and retention of CDL drivers.

The bi-partisan bill calls for temporary tax credits for truckers who may fit in any of the following scenarios:

- Truck drivers who logged a minimum of 1,900 hours of on-duty time and whose adjusted gross income for the taxable year does not exceed $135,000 jointly would qualify for a $7,500 tax credit.

- Truck drivers who meet the above on-duty criteria with a gross income of $112,500 as head of household would qualify for a $7,500 tax credit.

- Truck drivers who meet the above on-duty criteria with a gross income of $90,000 individually would qualify for a $7,500 tax credit.

- New drivers, defined as someone "who did not drive a commercial truck in the course of a trade or business during the preceding taxable year" would qualify for a $10,000 tax credit.

Taking Trucker Requests Seriously

It’s worth noting the bill authorizes grants to states and private agencies for expanding and improving truck parking, which has been a long-standing complaint among truckers throughout the country. In fact, it ties with driver compensation at number one on the American Transportation Research Institute’s (ATRI) Top Trucking Industry Issues (TII) report.

The bill also proposes streamlining the process for obtaining CDLs, which reduces the hurdles states and third parties often face when administering CDL tests. If this proposal has encouraged you to get behind the wheel of a big rig, check out this related Foley article to learn all about CDL endorsements and restrictions and which ones you should earn for your desired career path.

If you had a CDL at one time and it has expired, this bill may encourage you to renew it and get back on the road. Don’t worry, there’s a Foley article to help you too: How to Handle an Expired CDL.

What This Truck Driver Tax Credit Bill Means for Businesses

These truck driver tax credits are expected to entice more drivers to continue their careers in trucking, and encourage others to complete training and take a CDL test in order to qualify for them. While this bill is intended to support the supply chain and the drivers who keep it moving, it may also increase the number of applications your company receives for your open driver positions in the coming months.

Boost Your Efforts to Recruit Truck Drivers Now

If your company hires CDL drivers and is expecting to grow in 2023, now is the time to get your recruiting and retention processes in the best possible shape. But how can you do that quickly, easily, and at the best price point? With hiring software that puts motor carriers and drivers first.

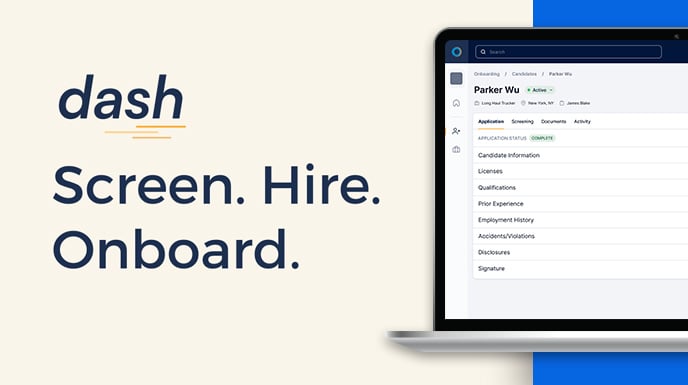

Foley’s digital, DOT-compliant application is just the start of successful CDL driver recruiting. Shortly, we’ll also offer a complete employee recruiting, onboarding, and management software solution featuring our well-known application, with a few new features.

Applicants will be able to apply to your positions using their mobile device when it works best for them, since they’ll have the ability to stop and save their progress at any point.

Uploading their required documentation, such as CDLs and medical cards, will be easier than ever too. If a driver is hired, these documents automatically create their driver file. Your efforts to recruit truck drivers and stay compliant have never been so seamless.

Get a free demo of our compliance solution now and stay tuned for our upcoming software launch! Submit the form below and let's get started.

Related Articles

Monitoring to Maintain a Safe Workforce

Going Digital: Where to Find Drivers

The Importance of Driver File Confidentiality

.png)